Trading finance online has revolutionized the way people engage with the world of finance. With just a few clicks, anyone can embark on a journey of becoming a skilled trader. But how does online trading work, and what does it take to master this art? In this article, we will delve into the realm of trading, unraveling its secrets and equipping you with the knowledge to unleash your inner trader. Whether you’re a beginner or an experienced investor looking to expand your horizons, read on to discover the fascinating world of online trading and embark on a path of financial empowerment. Get ready to explore the intricacies of the trade and learn how to navigate the ever-changing market landscape. It’s time to set your sights on mastering the art of trade and unlock your true potential.

Understanding the Basics of Online Trading

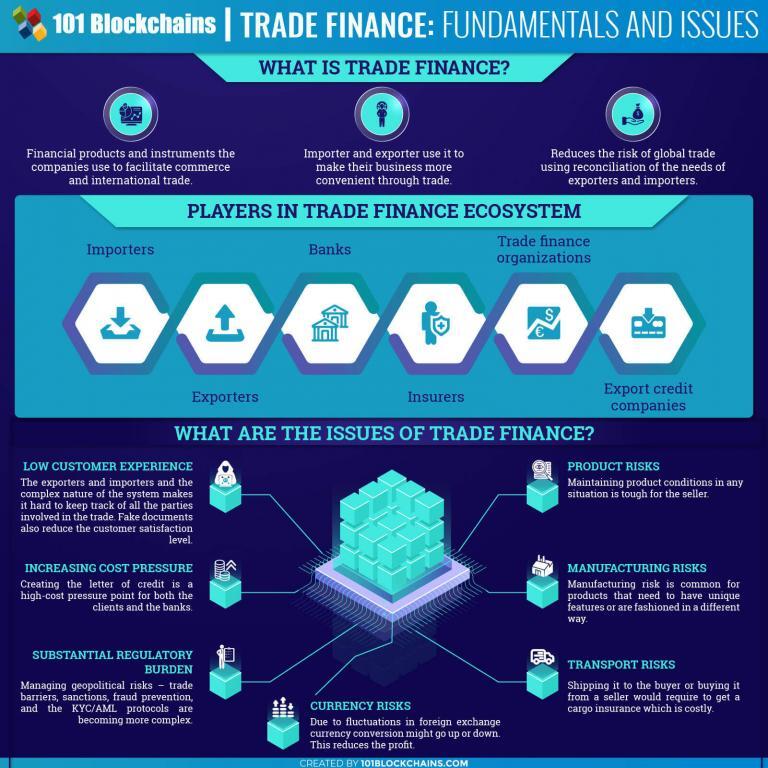

In the world of finance, online trading has become an increasingly popular method for individuals to participate in the financial markets. With just a few clicks, anyone with an internet connection can now engage in buying and selling various financial instruments, such as stocks, bonds, currencies, and commodities.

Online trading works by connecting traders to an online platform provided by brokerage firms or financial institutions. These platforms serve as the intermediary between the traders and the financial markets. Through the platform, traders can access real-time market data, place orders, and monitor their trading positions.

CentralPlusFinance

To start trading online, you typically need to open an account with a brokerage firm. Once your account is set up, you can deposit funds into it, which will serve as your trading capital. Most online trading platforms also provide educational resources and tools to help you make informed trading decisions.

When it comes to online trading, there are different approaches you can take. Some traders opt for day trading, where they aim to profit from short-term price fluctuations within a single trading day. Others may choose swing trading, which involves holding positions for a few days or weeks to take advantage of larger market movements.

It’s important to note that online trading carries risks, and it’s crucial to have a solid understanding of the markets and risk management strategies. It’s advisable to start with small investments and gradually increase your exposure as you gain experience and confidence in your trading abilities.

In the next sections, we will delve deeper into the various aspects of online trading and provide insights on how you can master the art of trade and unleash your inner trader. Stay tuned for more valuable information to come!

Choosing the Right Online Trading Platform

When it comes to online trading, selecting the right platform is crucial for your success. With the wide array of options available, it can be overwhelming to determine which platform is best suited to your needs. However, by considering a few key factors, you can make an informed decision.

Firstly, it’s essential to evaluate the user experience offered by different online trading platforms. A user-friendly interface and intuitive navigation can greatly enhance your trading experience. Look for platforms that provide easy access to relevant information and tools, allowing you to make informed decisions quickly.

Secondly, consider the range of financial instruments available for trading on each platform. Depending on your trading goals, you may be interested in stocks, commodities, forex, or cryptocurrencies. Ensure that the platform you choose offers a diverse selection of assets that align with your investment preferences.

Lastly, it’s crucial to evaluate the security measures implemented by online trading platforms. Safeguarding your personal and financial information is paramount in today’s digital age. Look for platforms that utilize robust encryption protocols and have a strong track record of protecting their clients’ data.

By taking into account these factors – user experience, available financial instruments, and security measures – you will be on your way to mastering the art of online trading. The right platform can empower you to unleash your inner trader, offering opportunities for financial growth and success.

Mastering Trade Strategies and Risk Management

In the world of online trading, mastering trade strategies and risk management is vital to achieving success. By developing effective strategies and understanding how to manage risks, traders can increase their chances of making profitable trades. Let’s explore some essential aspects of trade strategies and risk management in online trading.

Consistency is Key

Consistency in trading strategies is crucial for long-term success. Rather than constantly changing strategies based on short-term fluctuations in the market, successful traders stick to their well-developed plans. This allows them to minimize impulsive decision-making and maintain a disciplined approach to trading. By being consistent in their strategies, traders can better identify patterns, seize opportunities, and make informed decisions.

Proper Risk Management

Risk management is an integral part of trading. It involves setting clear risk parameters and implementing strategies to protect your capital. One commonly used risk management technique is setting stop-loss orders. These orders help limit potential losses by automatically closing a trade position at a predefined price level. By utilizing stop-loss orders, traders can protect themselves from substantial losses in case the market moves against their position.

Diversify Your Portfolio

Diversification is a fundamental concept in risk management. By spreading investments across different financial instruments and markets, traders can reduce their exposure to specific risks associated with a single asset or market. The goal is to create a diversified portfolio that can absorb the impact of unfavorable market movements in one area while potentially benefiting from positive movements in others. Diversification helps mitigate risks and increases the chances of achieving consistent returns over time.

In conclusion, mastering trade strategies and risk management is essential for online traders aiming to navigate the dynamic world of financial markets successfully. By staying consistent with their strategies, implementing proper risk management techniques, and diversifying their portfolio, traders can increase their likelihood of making profitable trades while minimizing potential losses.