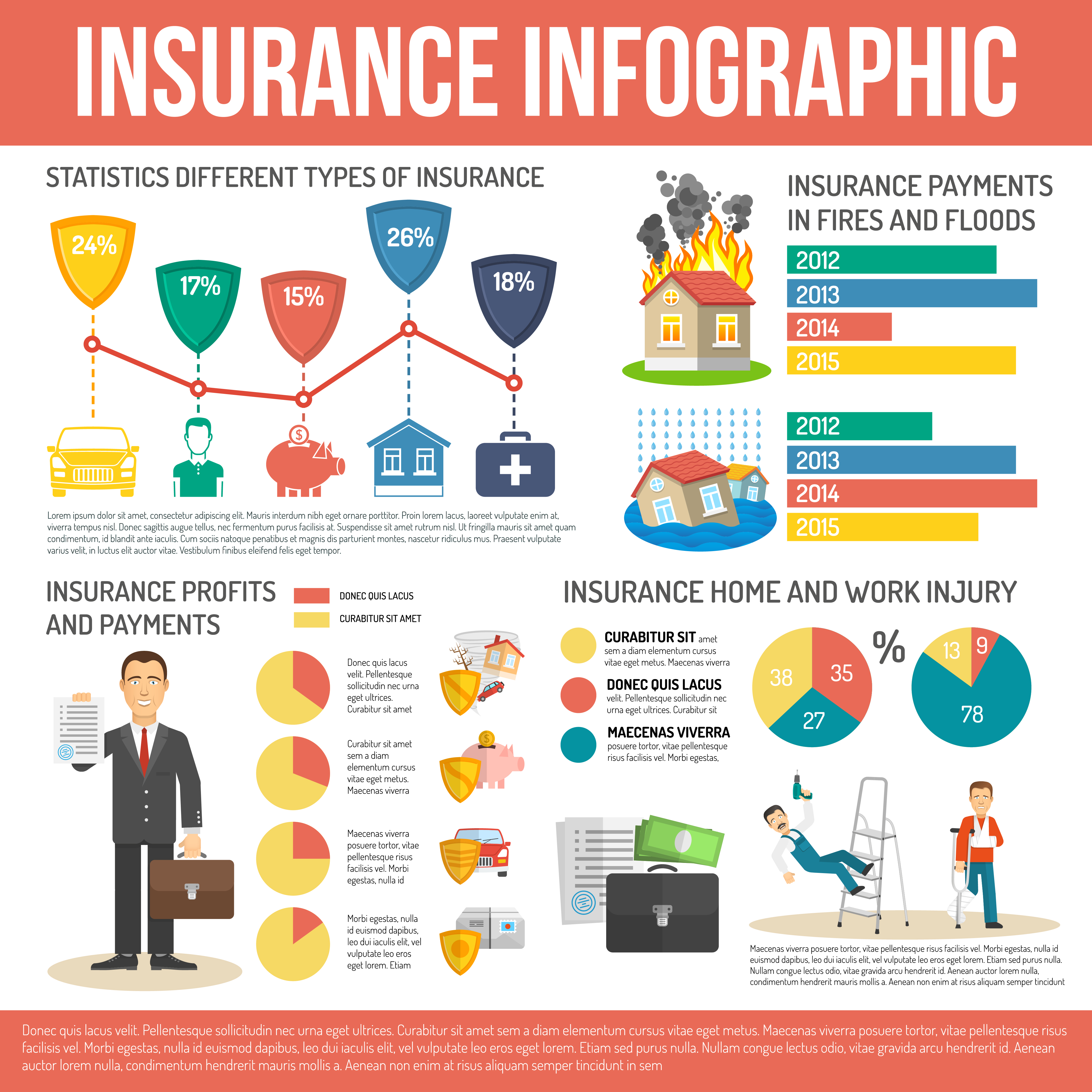

Starting a business is an ambitious endeavor that requires careful planning and foresight. One essential aspect that often gets overlooked in the midst of excitement and new beginnings is business insurance. Protecting your business against unforeseen events is not only prudent, but it can also be the key to ensuring long-term success. From safeguarding your employees with Workers Compensation Insurance to shielding your business from lawsuits with Directors and Officers (D&O) Insurance, understanding the various facets of business insurance is crucial in navigating the complex landscape of entrepreneurship. In this comprehensive guide, we will delve into the world of business insurance, shedding light on its importance, the different types of coverage available, and how to choose the most suitable policies for your unique business needs. So, whether you’re a startup founder or an established business owner, joining us on this journey will equip you with the knowledge and tools necessary to insure your success.

Understanding Workers Compensation Insurance

Workers Compensation Insurance is a crucial aspect of business insurance that provides coverage for employees who sustain injuries or illnesses while performing their job duties. This type of insurance helps protect both employers and employees by offering financial support and medical benefits in the event of a work-related incident.

Workers Compensation Insurance plays a vital role in ensuring the well-being and safety of employees. It helps cover medical expenses, rehabilitation costs, and lost wages for workers who experience injuries or illnesses directly related to their job. By providing this coverage, businesses can demonstrate their commitment to the welfare of their employees, fostering a positive and secure working environment.

Moreover, Workers Compensation Insurance not only benefits employees but also safeguards employers from potential legal liabilities. By having this insurance in place, businesses can minimize the risk of lawsuits resulting from workplace injuries, as it provides a legal framework for compensating employees for their injuries without resorting to litigation.

In summary, Workers Compensation Insurance is an integral part of business insurance. It ensures that employees receive adequate support and benefits if they suffer work-related injuries or illnesses, while also protecting employers from potential legal disputes. By understanding the importance of Workers Compensation Insurance, businesses can prioritize the well-being of their workforce and mitigate financial and legal risks.

Exploring Business Insurance Options

When it comes to protecting your business, having the right insurance coverage is crucial. One important aspect to consider is Workers Compensation Insurance. This type of insurance provides benefits to employees who suffer work-related injuries or illnesses. It not only protects your employees but also helps safeguard your business from potential legal claims and financial burdens.

Another key insurance option to consider is Business Insurance. This comprehensive coverage is designed to protect your business against various risks, such as property damage, liability claims, and business interruption. By having the right business insurance policy in place, you can ensure that your company stays afloat during unexpected events and minimize any financial losses.

Additionally, Directors and Officers (D&O) Insurance is another valuable option to consider. This type of coverage protects the directors and officers of your company from claims alleging wrongful acts, such as fraud, negligence, or breach of duty. D&O Insurance not only provides crucial protection for the individuals leading your organization but also helps attract talented leaders knowing they have the necessary coverage.

Remember, exploring different business insurance options and understanding their benefits is essential to make informed decisions for your business. Assess your company’s needs, consult with insurance professionals, and ensure that you select the right insurance policies for your specific requirements.

An Overview of Directors and Officers (D&O) Insurance

Directors and Officers (D&O) Insurance is a crucial aspect of business insurance that aims to protect the individuals who hold positions of power within a company, such as directors and officers, from potential legal and financial liabilities. This type of insurance coverage is specifically designed to safeguard these key personnel for decisions made during the course of their professional duties.

Insurance For Roofing Contractors

D&O Insurance provides coverage for claims arising from alleged wrongful acts committed by directors and officers in the execution of their duties. These wrongful acts may include errors in judgment, breaches of fiduciary duty, negligence, or misleading statements, among other things. Without adequate protection, these individuals may be personally liable for damages, legal fees, and settlements, putting their personal assets at risk.

One of the significant advantages of D&O Insurance is that it covers defense costs, which can be quite substantial even if the ultimate legal outcome is in favor of the director or officer. The policy typically extends coverage to legal representation expenses, administrative hearings, investigations, and settlements or judgments.

Additionally, D&O Insurance can be customized to cater to the specific needs of different companies, taking into consideration the type of business, industry, and the level of risk involved. It provides a safety net that promotes confidence and stability within the organization, allowing directors and officers to carry out their responsibilities without unnecessary fear of personal financial ruin.

In conclusion, Directors and Officers (D&O) Insurance plays a vital role in mitigating the potential risks faced by key personnel within a company. As the business landscape continues to evolve, having comprehensive insurance coverage becomes increasingly crucial for the long-term success and protection of directors and officers.