Owning a home is a dream come true for many. It’s a place where we make memories, feel safe, and build our lives. However, amidst all the joy and comfort, the unexpected can sometimes disrupt our peace of mind. That’s where home insurance comes into play, serving as a protective shield for our biggest asset.

Home insurance is not just another expense we add to our bills; it’s a crucial investment that ensures the security and financial stability of our homes. Whether it’s protecting us from natural disasters, unforeseen accidents, or liability claims, home insurance gives us the peace of mind we deserve.

But understanding insurance can be overwhelming, especially with the multitude of policies and coverage options available. From contractor insurance to general liability insurance, bonds insurance to workers comp insurance, there are various facets of home insurance that can be confusing. That’s why we’re here to unveil the secrets of home insurance and help you navigate through the intricacies of protecting your home and peace of mind. So, let’s dive in and discover all you need to know about home insurance.

Understanding Home Insurance

Home insurance is a vital safeguard for protecting your most valuable asset: your home. It provides financial coverage in the event of unexpected damages or losses that can occur to your property. With the right home insurance policy, you can have peace of mind knowing that you are protected against various risks and uncertainties.

One important aspect of home insurance is the coverage it provides for your dwelling. This includes the structure of your home itself, as well as any attached structures such as garages or sheds. In the event of damages caused by fire, storms, or other covered perils, your insurance policy will help cover the cost of repairs or even the cost of rebuilding your home from scratch.

In addition to protecting the physical structure of your home, home insurance also offers coverage for your personal belongings. This includes items such as furniture, electronics, appliances, and clothing. If your belongings are damaged or stolen, your insurance policy will typically help reimburse you for their value, allowing you to replace them without bearing the full financial burden.

Overall, home insurance is essential for preserving your home and providing peace of mind. By understanding the different aspects of coverage and finding the right policy for your needs, you can ensure that you are protected against unforeseen events and losses that could otherwise put a strain on your finances.

Michigan insurance agency

Types of Insurance for Homeowners

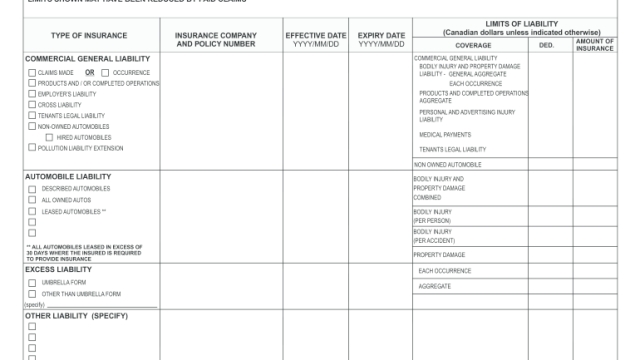

Homeowners insurance provides essential protection for your most valuable asset, your home. However, there are other types of insurance that homeowners should be aware of to ensure comprehensive coverage. In addition to home insurance, contractors insurance is particularly important if you plan to hire professionals for any renovation or construction work on your property.

Contractor insurance, also known as general liability insurance, provides coverage for any damages or accidents that may occur during the course of the project. This type of insurance protects both the homeowner and the contractor, ensuring that any unforeseen circumstances do not lead to financial burdens or legal disputes.

Another important type of insurance for homeowners is bonds insurance. Bonds can provide reassurance that the contractor you hire will fulfill their obligations and complete the project to your satisfaction. By providing financial security, bonds insurance minimizes the risks associated with hiring contractors and helps maintain peace of mind throughout the construction process.

Lastly, workers comp insurance plays a crucial role in protecting homeowners from any liability in case a worker gets injured while working on their property. This type of insurance ensures that medical expenses and any potential legal costs are covered, relieving homeowners from potential financial burdens.

Understanding these different types of insurance beyond the typical home insurance can provide homeowners with a comprehensive safety net. By incorporating contractor insurance, bonds insurance, and workers comp insurance into your coverage plan, you can truly protect your home and enjoy peace of mind.

Importance of Contractor Insurance

Contractor insurance is of utmost importance when it comes to safeguarding your home and peace of mind. As a homeowner, it is crucial to understand the significance of contractor insurance in order to protect yourself and your property from any potential risks or liabilities.

The first aspect to consider is general liability insurance. This type of insurance provides coverage for damages or injuries that may occur on your property during construction or renovation projects. Without general liability insurance, you could be held financially responsible for any accidents or mishaps that happen on your premises.

Additionally, bonds insurance is another essential component of contractor insurance. Bonds offer a level of protection in case the contractor fails to fulfill their obligations as per the agreed-upon contract. This insurance ensures that you are not left stranded with an incomplete or subpar construction project, providing you with a sense of security and assurance.

Lastly, workers comp insurance is vital when hiring contractors for your home projects. This insurance covers any medical expenses or lost wages for workers who may be injured while working on your property. By ensuring that the contractors you hire have workers comp insurance, you protect yourself from potential lawsuits and financial strains that can arise from workplace injuries.

In conclusion, contractor insurance plays a crucial role in protecting your home and providing you with peace of mind. General liability insurance, bonds insurance, and workers comp insurance are all essential components that shield you from potential risks, liabilities, and financial burdens. By understanding the importance of contractor insurance and ensuring that contractors have the necessary coverage, you can embark on your home projects with confidence and security.