Business finance is a crucial aspect of any successful enterprise. Whether you’re starting a new venture or managing an established company, understanding the ins and outs of business finance is key to making informed decisions and achieving financial stability. In this article, we will explore the world of business finance, delving into its various components and providing you with a comprehensive guide to navigate the intricate landscape of financial management. From budgeting and cash flow management, to capital investment decisions and funding strategies, mastering the art of business finance can be your pathway to sustained success.

One of the fundamental aspects of business finance is understanding the complexities of tax law and its implications on your entrepreneurial endeavors. Effective tax planning and compliance are vital to ensure that you adhere to legal requirements and optimize your tax position. With a comprehensive business tax law guide, you’ll gain insights into navigating the ever-evolving tax landscape, managing your tax liabilities, and leveraging tax incentives to your advantage. By mastering the intricacies of business tax law, you can effectively minimize risks, maximize profitability, and drive your business towards greater financial prosperity. So, let’s dive into the world of business finance and embark on a journey towards achieving financial excellence!

1. Business Finance Guide

In the world of business, mastering the art of finance is paramount to achieving success. Business finance plays a crucial role in the financial health and growth of any organization. It encompasses various aspects such as managing cash flow, making investment decisions, and understanding the financial implications of business operations.

One of the fundamental elements of business finance is understanding how to effectively manage cash flow. Cash flow management involves monitoring the inflow and outflow of cash in a business to ensure there is enough liquidity to meet financial obligations and seize opportunities for growth. By maintaining a healthy cash flow, businesses can avoid potential cash shortages and make informed decisions about managing expenses and investments.

Another important aspect of business finance is making sound investment decisions. This involves analyzing potential investment opportunities and weighing the risks and rewards associated with each option. Understanding financial concepts such as return on investment (ROI) and net present value (NPV) can help businesses evaluate the profitability and viability of investment projects. By making informed investment decisions, businesses can allocate their resources effectively and maximize their returns.

Finally, business finance also encompasses the knowledge of business tax laws. Being aware of the applicable tax regulations and understanding how they impact the financial aspects of a business is crucial. This includes understanding tax deductions, tax credits, and compliance requirements. By staying abreast of tax laws and regulations, businesses can ensure they are in compliance and optimize their tax planning strategies.

Mastering the art of business finance can provide a competitive edge to organizations of all sizes. By effectively managing cash flow, making informed investment decisions, and understanding tax laws, businesses can navigate financial challenges, make strategic choices, and ultimately pave the path to success.

2. Business Tax Law Guide

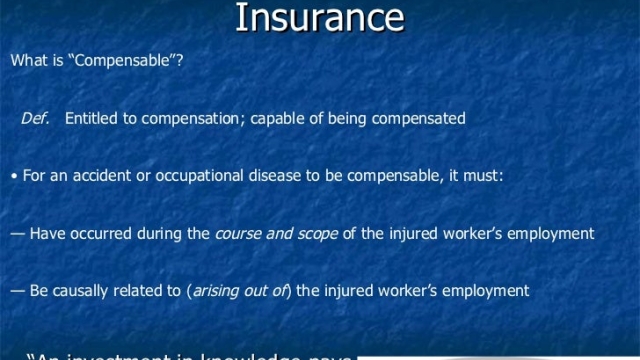

Understanding the intricate world of business tax law is crucial for managing your finances effectively. In this section, we will provide you with a comprehensive guide to navigate through the complexities of this field.

Stay Compliant:

Complying with business tax laws is essential to avoid any legal ramifications. It is vital to familiarize yourself with the tax regulations that pertain to your specific industry. Ensure that you are aware of filing deadlines, tax payment schedules, and any relevant forms or documentation required by the authorities.Seek Professional Guidance:

Microcaptive

Navigating the complexities of business tax law can be challenging, especially for those without a background in finance or accounting. Seeking professional guidance can prove to be immensely helpful. Hiring a certified tax accountant or tax attorney can provide you with expert advice, ensure compliance, and help you optimize your tax planning strategies.Regularly Review Tax Laws:

Tax laws are subject to frequent updates and revisions. It is crucial to stay informed about any changes that may impact your business. Regularly review tax laws, subscribe to newsletters, and consult with professionals to remain up to date with the latest regulations. Being proactive in understanding tax laws can help you make informed decisions and minimize any potential risks or penalties.

Remember, mastering business tax law is an ongoing process. By staying compliant, seeking professional advice, and staying updated with the latest developments, you can effectively manage your tax obligations while maximizing your financial success.

3. Key Considerations for Financial Success

In order to achieve financial success in business, it is important to consider several key factors. By being mindful of these considerations, you can effectively navigate the world of business finance and increase your chances of success.

First and foremost, having a solid understanding of business finance is crucial. This involves being well-versed in concepts such as budgeting, forecasting, and financial analysis. By mastering these skills, you will be able to make informed financial decisions and effectively manage your company’s resources.

Another important consideration is staying up-to-date with the ever-changing landscape of business tax laws. With tax laws constantly evolving, it is crucial to have a comprehensive understanding of how they impact your business. This will help you maximize tax benefits, minimize liabilities, and ensure compliance with legal obligations.

Furthermore, developing strong relationships with financial experts is essential for financial success. Whether it’s working with a trusted accountant or engaging with financial advisors, having access to professional guidance can be invaluable. These experts can provide insights, offer strategic advice, and help you navigate complex financial situations.

By taking into account these key considerations, you will be well on your way to mastering the art of business finance and setting yourself up for success in the competitive world of entrepreneurship.