In a rapidly evolving financial landscape, the concept of an integrated credit system is gaining significant traction. Businesses are increasingly turning to advanced software solutions to streamline their credit processes and enhance efficiency. WinFactor™ stands at the forefront of this evolution, offering a cloud-based factoring software that boasts over 28 years of expertise in the industry. This premier solution is designed to provide a seamless experience for managing credit, invoice processing, and funding options, all within a single, integrated platform.

With WinFactor™, businesses can experience unparalleled levels of efficiency and risk management, empowering them to make more informed credit-related decisions. The innovative WinFactor™ Wallet further enhances the flexibility of funding options available, ensuring that companies have access to diverse financial resources. As the boundaries between traditional and digital financial systems continue to blur, the importance of an integrated credit system cannot be overstated. WinFactor™ exemplifies the future of credit management, offering a comprehensive solution that sets new standards in the industry.

Benefits of Integrated Credit System

An integrated credit system offers a streamlined approach to credit management, enhancing overall operational efficiency. With WinFactor™’s integrated credit system, businesses can seamlessly assess creditworthiness, monitor credit limits, and make informed credit decisions in real time. This proactive approach minimizes credit risks and improves cash flow, paving the way for sustainable growth and financial stability.

By utilizing an integrated credit system, organizations can centralize credit data and streamline communication across departments. This enhances collaboration between sales, finance, and credit teams, leading to better alignment in credit policies and decision-making processes. With WinFactor™’s comprehensive software solution, businesses can achieve greater transparency and accountability in credit management, fostering a culture of risk awareness and compliance.

Another key benefit of an integrated credit system is the ability to leverage advanced analytics and reporting tools. WinFactor™ empowers businesses to analyze credit performance metrics, identify trends, and forecast credit needs with precision. By harnessing data-driven insights, organizations can optimize credit strategies, mitigate financial risks, and capitalize on growth opportunities with confidence.

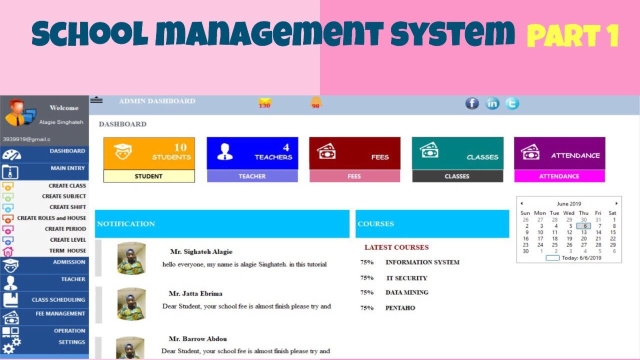

Efficiency of WinFactor™ Software

WinFactor™ is at the forefront of revolutionizing the credit industry with its cutting-edge software solution. By integrating credit processes seamlessly into a unified system, WinFactor™ has redefined efficiency in factoring operations. This means smoother invoice processing and quicker access to diverse funding options, ultimately enhancing overall productivity.

With over 28 years of experience backing it up, WinFactor™ has honed its software to provide unparalleled efficiency and risk management capabilities. The integrated credit system allows for real-time data analysis, enabling businesses to make informed decisions swiftly. This instant access to crucial credit information translates into faster funding approvals and reduced processing times, giving companies a competitive edge in the dynamic credit landscape.

Furthermore, WinFactor™’s innovative WinFactor™ Wallet complements the integrated credit system by offering a variety of funding options tailored to meet the unique needs of different businesses. This flexibility not only streamlines the funding process but also ensures that companies can access the capital they need when they need it most. In essence, WinFactor™ software is not just efficient; it is a game-changer in the realm of credit management.

Invoice Financing Platform

Risk Management with WinFactor™

WinFactor™ aims to revolutionize risk management in the credit industry through its cutting-edge software solution. By seamlessly integrating various data points and advanced analytics, WinFactor™ provides real-time insights into the creditworthiness of clients, enabling businesses to make informed decisions with confidence.

With over 28 years of expertise in the industry, WinFactor™ has fine-tuned its risk management processes to minimize potential losses and maximize profitability for its clients. Leveraging the power of technology, WinFactor™ employs sophisticated algorithms to identify and mitigate potential credit risks proactively, ensuring a secure and reliable factoring experience.

The innovative WinFactor™ Wallet further enhances risk management capabilities by offering diverse funding options tailored to individual business needs. By providing access to a range of funding sources, WinFactor™ enables businesses to optimize their cash flow and mitigate potential financial risks, setting a new standard for integrated credit systems in the digital era.